November 11, 2024

A New Era of Productivity: Why Innovation Matters Now

Advertisements

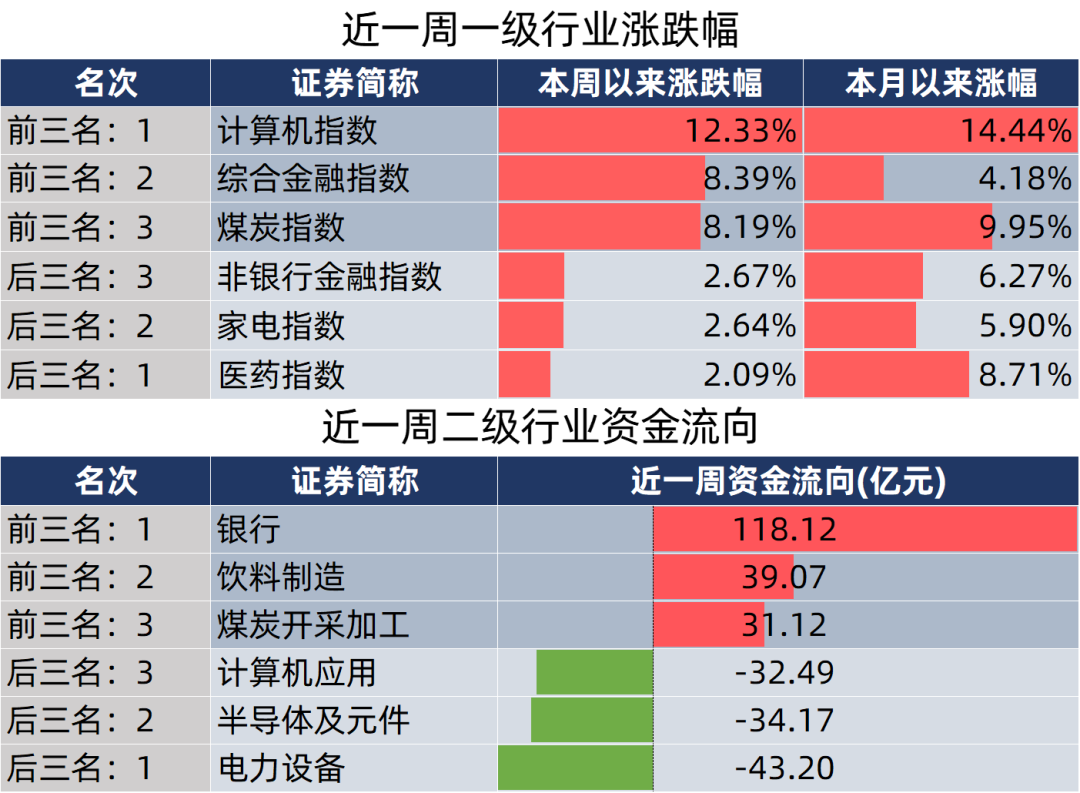

In the past week, the Shanghai Composite Index has shown remarkable momentum, achieving five consecutive days of gains and a total of eight winning days. This surge has been spearheaded by micro-cap stocks, which have recently skyrocketed by an astonishing 24.82%. Just a month ago, these micro-cap stocks faced significant declines, plummeting nearly 50%, and even with a recent rebound over the last six days, they still have about 30% more to recover to their previous highs.

The standout sector of the week has been the Sora concept, which centers on multimodal technologies and video generation. This emerging field has seen incredible growth, with some strong-performing stocks delivering approximately 200% gains over just six days. Additionally, the multimodal concept index surged roughly 38% during the same time frame. The lucrative behavior observed within the Sora sector has sparked further interests in various offshoots of artificial intelligence, including the concepts of computing power and data centers, as well as specific segments like optical modules and computing power leasing.

Furthermore, the robust performance of companies like Nvidia has fueled the momentum in the optical modules and computing component markets. The optical modules index rose about 16% over the past week, while the computing leasing sector saw an impressive increase of around 22%. Contributing to this growth were insights from a State-owned Assets Supervision and Administration Commission meeting that focused on "AI Empowerment and Industry Renewal," which led to a 19% increase in the data center sector.

From a fundamental analysis perspective, the domestic landscape is witnessing a significant shift. The recent substantial reduction in the five-year Loan Prime Rate (LPR) represents the highest single drop in history, aimed at benefiting the real economy. Previously, the LPR for terms over five years had remained unchanged for seven consecutive months, while the one-year rate had been stable for five months. The asymmetric reduction in LPR, after a two-year interval, underscores a strong signal for stabilizing growth and alleviating existing debt pressures while stimulating demand.

On the international front, the minutes from the Federal Reserve’s January meeting revealed concerns among officials regarding hastily reducing interest rates. During that meeting, decision-makers generally agreed that the current policy rate might represent the peak of the current rate-hiking cycle, acknowledging that the risks of rising inflation had diminished but remained vigilant about future rate cuts. They expressed uncertainty over how long high-interest rates might be sustained, with several officials mentioning the risks associated with speeding up the reduction. In light of the recently published data, January’s Consumer Price Index (CPI) in the US saw a year-on-year increase of 3.1%, raising market expectations for a resurgence in US inflation. Attention now shifts to the PCE data due for release in January and discussions surrounding the asset-liability balance at the March Federal Reserve meeting.

When it comes to capital on the market, the sentiment has been fluctuating. The average daily trading volume has been approximately 902.784 billion yuan, with a slight decline in total turnover. On the foreign capital front, net inflows continued into the market, with a total of 10.697 billion yuan over the week, compared to 16.082 billion yuan the previous week. Furthermore, as of February 22, the financing balance on-site reached 1.451984 trillion yuan, marking an increase of 30.867 billion yuan over the last week, with a higher proportion of financing purchases, indicating a rising preference for leveraged funds.

Looking ahead, the loosening of monetary conditions is poised to accelerate the restoration of risk appetite in the markets, opening up a window for bullish strategies. The reduction in the five-year LPR, combined with unexpectedly strong financial data from January, signals a return to a more favorable investment climate. The strengthening of supportive policies aimed at boosting the economy and capital markets indicates continued inflows into both large and small-cap stocks, helping to mitigate liquidity shocks and pressure on stock holdings. With the stabilization of the internal and external macroeconomic environment, market sentiment is gradually recovering, and it is anticipated that there will be no significant risks leading up to the Two Sessions and the March Federal Reserve meeting.

As the market currently stands, high-dividend segments are where the excitement is, particularly fueled by the broader technology sector inspired by the Sora model. For those interested in undervalued yet high-dividend stocks, the willingness and strength of purchasing is notably robust. The Sora-related technology sector has previously experienced significant overselling, indicating that momentum for recovery remains strong. However, investors must be cautious about not overstretching their positions and engaging in high-priced purchases.

A new wave of consumer products and large-scale equipment upgrades could provide essential support for related sectors. Changes in consumer goods will primarily involve the replacement of durable items such as automobiles and home appliances. The discussions surrounding these upgrades underline a partnership between the central government and local authorities that will enhance product sales in the car and appliance industries with subsequent subsidy policies. Given the fundamental conditions within these industries, the elasticity of the home appliance sector stands to benefit significantly. Major home appliance manufacturers have consistent performance that outweighs market expectations, indicating that the impact of the real estate sector has been less detrimental than initially thought. Should the replacement policies be implemented, particularly for leading companies in the home appliance sector, their performance could continue to improve.

As the current week transitions into the Two Sessions period, a key term that has emerged is "new productivity" which warrants serious attention especially with the upcoming third plenary session, likely forthcoming discussions regarding new ideas and concepts associated with this term.

Leave a Comment